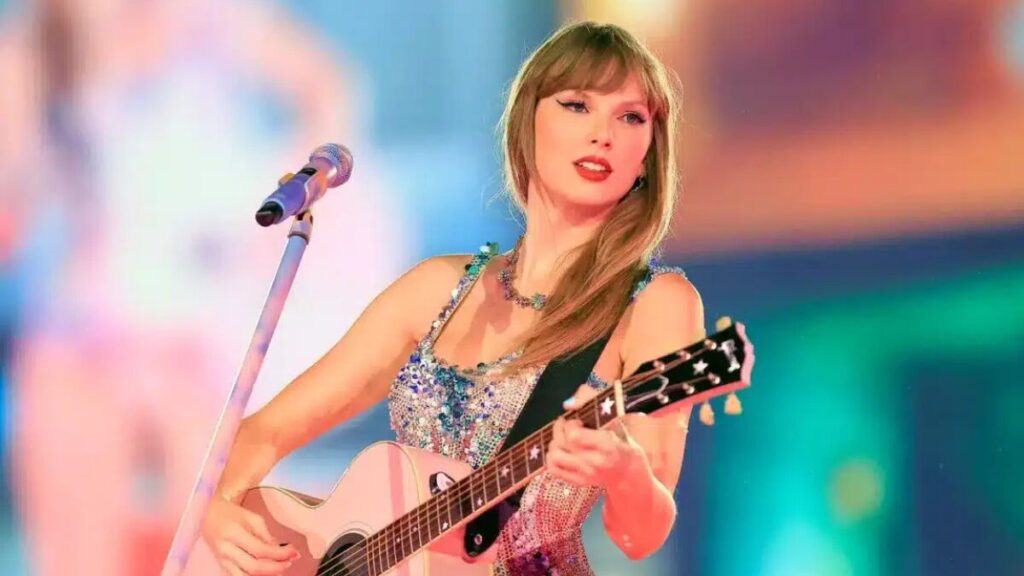

In 2025, Taylor Swift is worth an estimated $1.6 billion — and she didn’t get there through tech startups, IPOs, or inherited trust funds. She sang her way to it, night after night, city after city, turning a 146-show tour into an economic engine that rivaled small countries.

The Eras Tour wasn’t just a concert series — it was a cultural flashpoint and financial phenomenon, reportedly generating over $4 billion in global consumer spending. While stadiums filled with friendship bracelets and folklore cosplay, Swift quietly rewrote the rulebook on celebrity wealth: own your art, control your masters, and treat every album like a startup launch.

What makes her ascent rare isn’t just the size of the number. It’s the math behind it — powered not by middlemen, but by an artist who outmaneuvered the very industry that once told her to “stay in her lane.” This isn’t just a net worth milestone. It’s a masterclass in modern fame and a turning point in how value is built in the music world.

Breaking the Billion-Dollar Ceiling — Taylor Swift’s Net Worth in 2025

As of mid-2025, Taylor Swift’s net worth is estimated at $1.6 billion, according to Forbes and other financial trackers — a figure that officially crowns her one of the most successful self-made artists in history. But this isn’t just another celebrity stacking endorsement deals. What sets Swift apart is how she built her fortune largely on her terms — and, crucially, from her creations.

The leap from approximately $740 million in 2023 to billionaire status wasn’t the result of a single windfall — it was the culmination of a multi-pronged strategy playing out in real time. The centerpiece? The Eras Tour, a 2023–2024 juggernaut that shattered global records with over $1 billion in gross ticket sales and generated an estimated $200–300 million in personal profit for Swift once merch, licensing, and her self-produced concert film were factored in.

But the tour was just one chapter. Swift’s bold move to re-record her first six studio albums, known as “Taylor’s Versions,” has paid long-term dividends. Because she owns the rights to these new masters, every stream, sync license, and vinyl purchase now lines her pocket directly, without label middlemen taking their cut. Add to that a steady stream of publishing royalties, brand licensing, and film/TV sync placements, and you get a financial ecosystem that’s both diversified and remarkably self-contained.

In short, Taylor Swift didn’t just earn more — she kept more, thanks to savvy ownership, strategic timing, and a lifelong understanding of how power works in the entertainment industry.

Still wondering how Swift crossed into billionaire territory? Read our full breakdown: Is Taylor Swift a billionaire? Her wealth explained by category.

From Country Roots to Global Icon — A Career of Smart Pivots

The Nashville Spark: Early Success in Country Music

Long before billion-dollar tours and brand ownership, Taylor Swift was negotiating her place in a grown-up business at just 14 years old. When most teens were thinking about high school dances, she was insisting on writing her own songs — a move that would later secure her not just credibility, but publishing rights that still pay off today.

Her 2006 self-titled debut album wasn’t just a country success — it was a proof of concept. Backed by Big Machine Records, Swift didn’t just perform; she co-wrote or solely penned nearly every track, ensuring she had a long-term stake in her catalog. She hit the road hard, opening for major acts, honing her live chops, and building a direct connection with fans — the earliest version of what would become “The Swiftie Effect.”

Even then, her career choices weren’t accidental. They were precise, repeatable bets: own your voice, learn the business, and always be the one steering the story. The mogul was already in motion — she just hadn’t dropped the mic yet.

Want to see how her fortune grew year by year? Dive into the full Taylor Swift net worth timeline from 2006 to 2025.

Going Pop — and Going Global

When Taylor Swift pivoted to pop with 1989 in 2014, it wasn’t a rebrand — it was a power play. She wasn’t chasing trends; she was reshaping them, ditching country radio for global chart dominance. The album debuted at No. 1, sold over 10 million copies, and marked the start of a new era: one where Swift wasn’t just the face of her work — she was its architect.

She didn’t just change genres; she recalibrated control. In 2014, she pulled her catalog from Spotify, arguing that music shouldn’t be free — a bold stance that reframed the streaming economy. In 2019, she escalated the battle, going public about her lack of ownership over her first six albums after Scooter Braun acquired Big Machine Records. The result? Taylor’s Versions — a rare and wildly successful attempt to reclaim intellectual property in real time.

At every step, Swift used disruption to her advantage. She didn’t just go pop — she expanded her empire, turning genre shifts and business fights into long-term leverage.

The Eras Tour — A $1 Billion Phenomenon

The Eras Tour didn’t just break records — it rewrote the playbook on what a live music event could be. Spanning continents and over 140 shows, Taylor Swift’s genre-spanning, three-hour spectacle grossed over $1 billion, with some estimates placing total economic impact — including travel, lodging, dining, and merchandise — near $4.6 billion globally. Cities lobbied to be included on the tour. Hotels sold out months in advance. Swifties turned every stop into a pilgrimage.

But the financial magic wasn’t just in the numbers — it was in the fan experience economy she built around it. From limited-edition merch drops to VIP packages that sold out instantly, Swift created micro-economies at every venue, where friendship bracelets became currency and stadiums felt more like festivals. The lines to buy merchandise sometimes started before sunrise — before fans even had tickets.

And then there was the Eras Tour concert film — self-financed, released directly through AMC, and grossing $261 million worldwide without a traditional studio deal. It was yet another signal that Swift wasn’t just performing — she was distributing, producing, and monetizing her art on her terms.

More than a tour, Eras was a brand blueprint, an economic engine, and a fan-love factory all rolled into one. And with it, Swift didn’t just earn hundreds of millions — she crossed the billionaire threshold, powered by the very people singing her lyrics back to her every night.

Curious how much she makes per show — including tickets, merch, and sponsors? See our full breakdown of Taylor Swift Eras Tour earnings.

The Business of Being Taylor — Brands, Ownership, and Licensing

Behind every stage, every stream, every carefully crafted lyric is something far less romantic — but far more powerful: a business model designed for longevity and control. Taylor Swift’s financial empire isn’t just about what she creates — it’s about what she owns.

Her re-recording strategy, known globally now as “Taylor’s Versions,” is a textbook case of intellectual property reclamation. After losing the masters to her first six albums in a highly publicized sale to Scooter Braun’s company, Swift responded not with resignation but with reinvention. She began re-recording those albums — and fans followed in droves, driving new streams and sales that bypass the old label and flow directly to her.

Behind the scenes, she runs her career through 13 Management, a tight-knit operation led by her father, advisors, and longtime publicist Tree Paine. Unlike many pop stars with sprawling, outsourced teams, Swift’s core circle remains lean — and fiercely protective of her brand.

She’s also become a licensing powerhouse. From syncing her songs in TV and film (with terms she controls) to selectively aligning with brands like Capital One and Apple, every deal feels on-brand, on-message, and on-Taylor’s-terms. No fast fashion lines. No overexposure. Just strategic placements that expand her cultural reach without diluting it.

In an industry where many artists are just talent-for-hire, Swift has quietly transformed herself into a fully vertical brand operation — creator, distributor, marketer, and owner. In short, she is the label now.

See how her brand deals, licensing strategies, and investments contribute to her billion-dollar fortune in our analysis of Taylor Swift’s business ventures and investments.

What She Owns — Real Estate, Catalogs, and Company Stakes

Taylor Swift doesn’t just buy homes — she builds enclaves. Swift’s real estate portfolio, valued at over $100 million, spans some of the most exclusive zip codes in America. In Manhattan, she owns a block of adjacent properties in Tribeca, effectively creating her private compound. There’s the historic Beverly Hills estate (once home to Samuel Goldwyn), a sprawling Rhode Island beach house where her infamous Fourth of July parties were born, and a tucked-away Nashville penthouse that nods to her country roots. Each property reflects not just wealth, but legacy building — residences chosen as much for their privacy and prestige as their long-term value.

But her most powerful asset? Her music catalog — specifically the Taylor’s Versions. These re-recordings give Swift total control over licensing and streaming revenue, a move rarely pulled off in the music industry. Every TV placement or Spotify stream of Red (Taylor’s Version) means the payout goes directly to her.

Swift also holds trademarks for lyrics, eras, and even her cats — a surprisingly valuable layer of intellectual property. While she’s not known for splashy VC investments, her quiet influence in entertainment financing (including her Eras Tour film deal with AMC) suggests a growing interest in ownership over optics.

Together, her portfolio tells a clear story: Swift isn’t just collecting — she’s curating an empire built on control, cultural capital, and long-term equity.

Explore Taylor’s $100M+ portfolio of homes in Tribeca, Nashville, Beverly Hills, and more in our feature on Taylor Swift’s real estate empire.

How She Compares — Taylor Swift’s Wealth vs. Entertainment Peers

As of 2025, Taylor Swift’s net worth sits at approximately $1.6 billion, placing her in elite company among global entertainers. But the way she got there? That’s where things diverge.

Take Rihanna — worth an estimated $1.4 billion, but primarily due to her stake in Fenty Beauty, a cosmetics powerhouse backed by LVMH. Her wealth stems more from entrepreneurial equity than music royalties. Beyoncé, valued around $600 million, blends music, film, Ivy Park fashion sales, and co-investments with husband Jay-Z. She’s diversified, but still intertwined with corporate partnerships.

Ed Sheeran, with a reported net worth near $350 million, represents the classic touring model — prolific, profitable, but without the same ownership of masters or branded ventures. And Drake (est. $250 million) continues to rack up music streams and partnerships but operates heavily within label infrastructure.

Swift’s model? It’s a rare hybrid: she’s the IP owner, the touring juggernaut, and the brand, all rolled into one. She doesn’t just monetize her art — she controls the channels that monetize it.

Want a detailed side-by-side comparison of these two icons? Explore our full breakdown of Taylor Swift vs Beyoncé’s net worth in 2025.

The Personal CEO — Inside Taylor’s Money Mindset

Taylor Swift doesn’t just make career decisions — she architects her autonomy. Her public persona may be grounded in emotion and storytelling, but beneath the lyrics is a strategist who treats her art like a high-stakes business.

The clearest signal of her mindset? The re-recordings. Swift didn’t just re-release old albums out of spite — she did it to reclaim economic control and prove a point about ownership in an industry that often strips it from artists. In her words: “Artists should own their work. I just happen to be in a position where I can do something about it.”

She surrounds herself with a small, trusted team — led by longtime publicist Tree Paine, parents Andrea and Scott Swift, and business partner Robert Allen of 13 Management. Unlike many celebrities, Swift avoids bloated entourages and investor hype. Her decisions are deliberate, data-informed, and deeply personal.

Whether it’s quietly trademarking album names before release or negotiating direct-to-theater film distribution, Swift’s every move reflects a mindset that blends emotional intelligence with executive clarity. She’s not just a performer — she’s her boardroom and brand.

A Billionaire Built on Fan Loyalty — The Swiftie Effect

There are fans, and then there are Swifties — a global community that doesn’t just stream albums or attend concerts, but functions like an unpaid marketing team, retail army, and loyalty program all in one. It’s no exaggeration to say Taylor Swift’s rise to billionaire status was fan-fueled, both emotionally and economically.

When she began re-recording her albums, it was Swifties who boycotted the original versions, helped Taylor’s Versions top charts, and flooded social media with explanations of why “ownership matters.” Their support wasn’t symbolic — it drove millions in sales and streaming revenue. In a fractured digital world, Swift’s audience behaves more like a brand tribe than a passive fandom.

During The Eras Tour, ticket demand shattered records, with over 4 million fans registering for Ticketmaster’s Verified Fan program — so many that the site collapsed. Merchandise sold out city by city, sometimes before shows even began. Even the Eras Tour concert film saw fans dressing up in theaters, buying multiple showings, and treating it like a live event — turning a limited-release film into a $261 million box office success.

This kind of loyalty isn’t an accident. Swift has cultivated it over years of direct fan engagement, easter egg culture, and digital transparency. The result? A community that generates revenue, defends her brand, and scales with every album drop — proving that in the attention economy, emotional connection is currency.

If You’ve Watched Her Like I Have

I remember exactly when I realized Taylor Swift wasn’t just writing songs — she was building a business in plain sight. It was 2019, and the headlines had erupted: Swift didn’t own her masters. Scooter Braun had acquired Big Machine Records, and with it, the rights to the music she wrote in her childhood bedroom. It was the first time I saw the full scope of her ambition — not as a celebrity scorned, but as a strategic thinker willing to go to war over ownership.

And then she started re-recording.

That move, bold and almost unheard of at her level, reframed her entirely for me. Not just as a songwriter or performer, but as a CEO with a clear long game. What kind of artist retraces their discography, not out of nostalgia, but to reclaim equity? Taylor did. And fans backed her with the kind of loyalty you don’t buy — you earn.

What’s wild is how casually she pulls this off. One minute, she’s baking cookies on Instagram. Next, she’s negotiating theatrical distribution for a concert film without a major studio — and earning $100 million from it.

If you’ve followed her closely, you know: Taylor Swift never stops creating. But more importantly, she never stops calculating. Every era has been more than a sound — it’s been a statement. And somewhere along the way, she stopped being just a pop star and became something rarer: a fully autonomous empire in motion.

What Taylor Swift’s Fortune Says About Modern Fame

Taylor Swift’s rise to billionaire status isn’t just a testament to talent — it’s a blueprint for the next generation of celebrity power. In an era where fame is often fleeting and monetization outsourced, Swift represents a counter-narrative: one where ownership, intentionality, and long-game thinking redefine what success looks like.

She’s shown that an artist can thrive without handing over their catalog, their brand, or their voice. That you can be wildly successful — not by playing the system, but by rebuilding it around yourself. Swift’s fortune isn’t just a number; it’s a reflection of how cultural influence, business savvy, and emotional resonance can coexist — and scale.

In the end, her billion-dollar net worth isn’t just impressive because she earned it. It’s impressive because of how she earned it: through art that mattered, fans who believed, and a refusal to let anyone else own her story. That’s not just a career — it’s a case study in modern creative leadership.

Mohit is a finance and entertainment writer specializing in celebrity wealth, brand strategy, and media empires. As Co-Founder of TheNetWorths.com, he brings over a decade of experience analyzing public income streams, endorsement deals, and the evolving creator economy.

16 thoughts on “Taylor Swift Net Worth 2025: How the First Music Billionaire Built a $1.6 Billion Fortune”