Calvin Harris wasn’t always a household name — but his sound was always destined for global stages. Long before topping charts with platinum-certified hits and commanding multimillion-dollar DJ residencies in Las Vegas, Harris was crafting synth-heavy tracks in his bedroom in Dumfries, Scotland, armed with little more than a battered laptop and a DIY ethos. What began as an experiment in electronic production evolved into one of the most lucrative music careers of the 21st century.

As of 2025, Calvin Harris’s net worth is estimated at $300 million, according to Celebrity Net Worth and industry analysts — a staggering figure that places him among the wealthiest DJs and producers in history. But this fortune wasn’t built on music alone.

In the following sections, we’ll explore how Harris transformed from a one-man Myspace act to a multifaceted business mogul. From streaming royalties and global hits to tech investments and brand partnerships, this is the story of how Calvin Harris turned soundwaves into a financial empire.

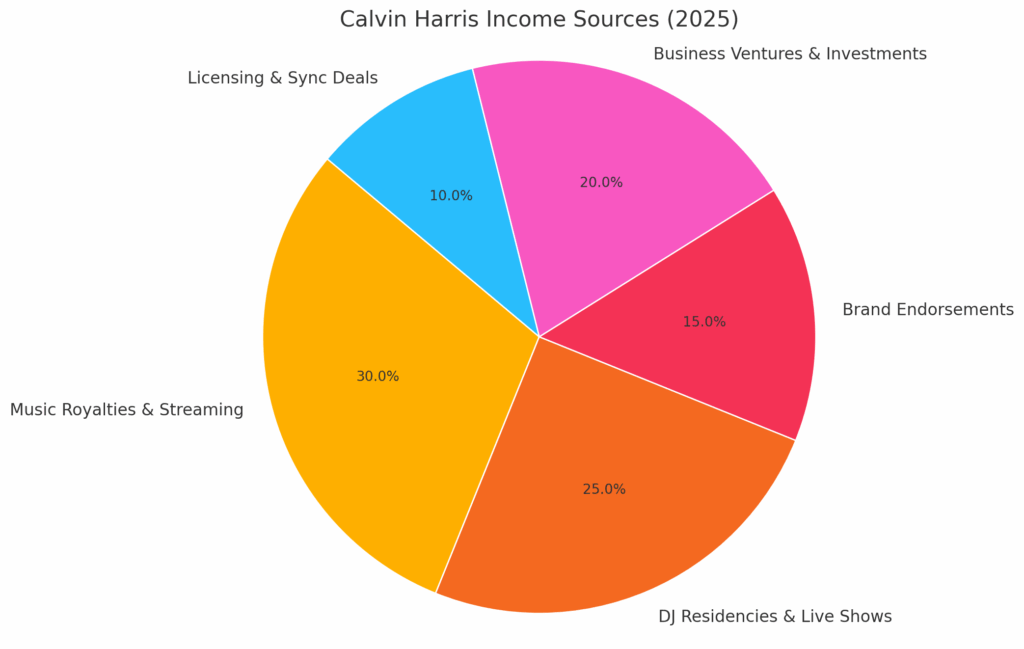

Net Worth Breakdown in 2025: Where the Money Comes From

Behind Calvin Harris’s $300 million net worth lies a meticulously diversified income portfolio that extends well beyond the DJ booth. While music remains at the heart of his empire, Harris has expanded his financial footprint through a blend of touring, brand partnerships, licensing deals, and savvy investments.

Royalties and Streaming: Still a Cash Cow: With over 40 billion combined streams across Spotify, Apple Music, and YouTube, Harris continues to earn an estimated $10–15 million annually from digital platforms alone. Hits like “One Kiss,” “This Is What You Came For,” and “Summer” still generate residual income nearly a decade after release.

DJ Residencies: The Vegas Goldmine: His multi-year residency deal with Hakkasan Group reportedly nets him $400,000–$500,000 per performance, contributing upwards of $10 million annually in performance fees. In 2025, Harris is expected to extend or renew a new Las Vegas contract — details pending but projected to surpass $50 million over multiple years.

Brand Deals and Licensing: From headlining campaigns for Emporio Armani to licensing his music for global ad campaigns and blockbuster films, Calvin Harris has remained brand-friendly without overexposure. Industry insiders estimate he brings in $5–7 million per year through licensing and partnerships.

Business Investments: Playing the Long Game: Recent investments in wellness startups, boutique record labels, and AI music tools are harder to quantify but show long-term potential. His quiet acquisition of a minority stake in a UK music tech firm in late 2024 underscores his interest in the evolving digital music economy.

The Hitmaker Era: How Music Royalties Made Millions

The Breakout Album That Started It All

Before Calvin Harris was commanding six-figure DJ fees in Vegas, he was just a 23-year-old Scot uploading quirky electro tracks to Myspace. That all changed in 2007 with the release of I Created Disco — a self-produced debut that blended retro synths with cheeky pop hooks.

The album featured breakout singles like “Acceptable in the 80s” and “The Girls,” both of which cracked the UK Top 10 and caught the attention of major labels. With its commercial success, I Created Disco sold over 250,000 copies in the UK alone, laying the groundwork for early royalty income and attracting licensing interest from advertising agencies and television.

These modest but consistent earnings not only validated Harris’s instincts as a producer but also helped him fund his next project without creative compromise — a pivotal move that would shape the rest of his career and income trajectory.

Chart-Toppers and Crossovers: Revenue from Global Hits

Calvin Harris’s rise to global superstardom was fueled by a string of smash singles that continue to generate millions in passive income. Tracks like “Summer,” “Feel So Close,” and “This Is What You Came For” (featuring Rihanna) have racked up billions of streams across Spotify, Apple Music, and YouTube.

Streaming estimates suggest these hits alone have earned Harris upwards of $30–40 million in lifetime revenue, thanks to premium royalties, publishing rights, and global airplay. Beyond digital platforms, the songs have been licensed for high-profile ad campaigns, Netflix originals, and Super Bowl commercials — each use adding another layer of residual income.

These crossover hits didn’t just top charts — they embedded Calvin Harris’s sound into global culture, making his catalog a lucrative asset that pays out year after year.

DJ Residencies and Touring Cash Flow

While streaming brought consistent income, it was Calvin Harris’s Las Vegas residencies that redefined his earning power. At venues like Hakkasan and Omnia, Harris commanded between $400,000–$500,000 per night, with multi-year deals reportedly totaling over $200 million since 2013. These exclusive gigs offered high pay with minimal travel — maximizing profit while protecting brand value.

Post-pandemic, the live music economy rebounded, but not without shifts. Harris played fewer global tours and instead focused on curated residencies and festival headliners, adapting to a climate where digital streams (via Spotify, Apple Music) grew more profitable. According to Forbes, this hybrid model of selective performances and constant streaming royalties has made Harris one of the most financially efficient acts in the business.

Beyond the Booth: Business Moves and Brand Expansion

Investments in Music Tech and Startups

While Calvin Harris made his name behind the decks, his financial savvy extends deep into the world of tech. Over the past decade, Harris has quietly built a portfolio of early-stage investments in music and creator-focused startups. These include backing music licensing platforms aimed at democratizing sync deals for independent artists and AI-powered tools that streamline music production workflows.

In 2021, he reportedly explored NFT integrations through limited-edition digital art releases tied to exclusive tracks — a move that blended fandom with emerging blockchain trends. Though not all ventures were headline-grabbing, insiders suggest Harris’s tech bets are strategic, focusing on scalability and creator equity.

By aligning his capital with innovations reshaping the music business, Harris isn’t just profiting from the future of sound — he’s helping shape it.

Skincare Line, Fashion Collaborations, and Real Estate Portfolio

Calvin Harris has quietly expanded his brand into lifestyle and luxury markets. In 2023, he partnered with a UK-based skincare startup — 111SKIN — to launch a limited-edition line targeting wellness-conscious creatives, adding a fresh, high-margin revenue stream to his portfolio.

Fashion-wise, Harris has fronted campaigns for Emporio Armani and collaborated on capsule collections that blend music culture with minimalist design — reinforcing his image as a style-forward global icon.

On the real estate front, Harris has made strategic acquisitions and sales in prime locations. He’s flipped multi-million-dollar properties in Beverly Hills, maintained a villa in Ibiza, and owns an estate in London’s upscale Hampstead. These holdings have not only appreciated in value but also reflect Harris’s refined taste in investment assets.

Comparing Wealth: Calvin Harris vs. His Peers

In the elite world of EDM, few names rival Calvin Harris in both global recognition and financial stature. As of 2025, his estimated net worth of $300 million firmly places him at the top of the DJ earnings pyramid — but how does he stack up against his closest peers?

| Artist | Estimated Net Worth (2025) | Primary Revenue Streams |

| Calvin Harris | $300 million | Music royalties, residencies, brand deals, business ventures |

| David Guetta | $200 million | Touring, production, song catalog sales |

| Diplo | $70 million | Touring, label (Mad Decent), collabs, streaming |

| The Chainsmokers | $160 million (combined) | Touring, branding, licensing |

While David Guetta has seniority and a vast catalog of hits, Harris edges him out through his consistent brand strategy, high-value Vegas residencies, and investments. Diplo, though prolific and omnipresent in the industry, has taken a more experimental and collaborative route, which translates to less solo-empire income. Meanwhile, The Chainsmokers — though a duo — have built a strong hybrid business model, but their combined net worth still trails Harris’s haul.

DJ Mag’s Top 100 DJ rankings consistently place Harris in the upper tier for influence, and Forbes has repeatedly listed him as the highest-paid DJ for much of the last decade. In terms of both cultural cachet and financial muscle, Calvin Harris remains in a league of his own.

One Man Brand: How Calvin Controls His Image and IP

Unlike many of his industry peers who rely on large teams or constant media cycles, Calvin Harris has carefully curated a brand that thrives on strategic silence, creative independence, and premium positioning.

Since his early days, Harris has retained substantial creative control over his music and image, often writing, producing, and performing his tracks. Even as his fame grew, he resisted the urge to overextend into reality TV, overexposure, or gimmicky media appearances — moves that have preserved his brand’s integrity and kept public interest high without burnout.

Harris has also skillfully navigated an industry often rocked by scandal, maintaining a notably low-drama public persona. Whether through limited interviews or tightly curated social media content, he communicates on his terms — offering glimpses of his work, lifestyle, and beliefs without sacrificing mystique.

This selective visibility has increased his value as a commercial entity. Brands, fans, and collaborators view Harris as a “safe but stylish bet” — a quality that enhances his long-term marketability and ensures continued leverage over his intellectual property, licensing decisions, and creative output.

“The Harris Effect”: Why His Strategy Still Resonates

As a longtime music journalist who’s covered the EDM boom from the bloghouse era to today’s AI-infused production landscape, I can say this confidently: Calvin Harris changed the game — and not just sonically. He redefined what it means to be a producer-artist in the digital age.

Back in the late 2000s, EDM stars were either behind-the-scenes hitmakers or festival headliners with limited crossover appeal. Harris was different. He played both roles masterfully — producing infectious tracks like “We Found Love” for Rihanna while simultaneously selling out arenas with his name on the marquee.

What set him apart? Strategic restraint and relentless control. While others chased the spotlight, Harris chased sustainability. A former Columbia Records A&R once told me, “He didn’t want to be the loudest voice in the room — he wanted to be the one you couldn’t ignore.”

That philosophy shows. He’s turned down reality shows, avoided scandal bait, and curated a brand that’s sleek, polished, and remarkably consistent. Even his social media posts are minimalist — sunlit studio shots, panoramic Ibiza views, and the occasional self-deprecating meme. It’s anti-hype in the best way.

For up-and-coming artists, “The Harris Effect” is a blueprint:

- Own your sound.

- Control your image.

- Think long-term, not viral.

In a genre built on big drops and bigger egos, Calvin Harris proved that longevity isn’t about being everywhere — it’s about knowing exactly where, when, and how to show up.

What’s Next? Forecasting Calvin Harris’s Financial Future

As Calvin Harris steps into 2025 with a $300 million fortune and no signs of slowing down, the question becomes: What’s next for one of music’s most calculated moguls? If history is any guide, his next moves will likely favor quiet innovation over flashy headlines.

Industry analysts forecast continued revenue growth from his back catalog, which benefits from long-tail streaming economics and consistent licensing demand. With Spotify and other DSPs (Digital Service Providers) exploring dynamic royalty models, Harris could see a 10–15% increase in catalog income alone over the next few years.

Beyond music, insiders point to a likely expansion into AI-assisted music tools — not to replace creativity, but to scale production efficiency. He’s also reportedly exploring a sustainable fashion label, tapping into the luxury-meets-eco-conscious market emerging in Ibiza and LA.

A potential wildcard? A quiet exit. Sources close to the industry suggest Harris may eventually sell part of his publishing catalog — a move that could net $100–150 million, following trends set by artists like Justin Bieber and David Guetta.

Whether he diversifies further or leans into legacy, Calvin Harris’s next chapter will be guided by the same principles that built his empire: precision, patience, and a pulse on what’s next in music, tech, and culture.

Sound Investments and the Science of Staying Relevant

Calvin Harris’s $300 million net worth in 2025 isn’t just the result of hit records — it’s the product of a deliberate strategy that fuses music mastery with business acumen. From his early days producing in a bedroom studio to headlining Vegas residencies and investing in cutting-edge tech, Harris has built a career defined by diversification, brand control, and musical consistency.

He’s one of the rare artists who’s just as comfortable on a festival stage as he is negotiating licensing rights or scouting startup investments. By staying scandal-free, choosing his partnerships wisely, and adapting to industry shifts without losing creative identity, Harris has secured a place not just at the top of EDM — but among the smartest entrepreneurs in entertainment.

As the music industry evolves, one thing is clear: Calvin Harris didn’t just ride the wave — he learned to own the ocean.

Mohit is a finance and entertainment writer specializing in celebrity wealth, brand strategy, and media empires. As Co-Founder of TheNetWorths.com, he brings over a decade of experience analyzing public income streams, endorsement deals, and the evolving creator economy.

2 thoughts on “Calvin Harris Net Worth 2025: How the DJ Mogul Built a $300 Million Empire”