In 2025, Elon Musk’s net worth isn’t just a number — it’s a barometer for where technology, power, and ambition collide. His fortune, which currently hovers around $380 billion, has become one of the most watched figures in finance, fluctuating wildly with each Tesla earnings call, SpaceX launch, or xAI announcement. Musk doesn’t just play in markets — he moves them.

Whether you see him as a visionary or a volatility machine, there’s no denying the gravitational pull of his wealth. This year alone, headlines have swirled around everything from Starlink’s rumored IPO to X’s experiment with AI-integrated payments, each one sending ripples across industries. Investors track his portfolio like weather patterns. Critics debate the ethics of so much capital tied to a single personality. Admirers point to his moonshot mindset as the blueprint of modern innovation.

But beneath the dollar signs lies a more fascinating story: how Musk’s unrelenting pursuit of disruption—from rockets to robots—continues to reshape not just his bank balance, but the very definition of billionaire influence in the 21st century.

Elon Musk in 2025: A Snapshot of His Current Net Worth

As of mid-2025, Elon Musk’s net worth is estimated at $380 billion, according to Forbes, depending on the day and the data source. According to the Celebrity Net Worth, he maintains a tight lead over Jeff Bezos and Bernard Arnault, though the gap narrows each time Tesla stock dips or another tech titan surges.

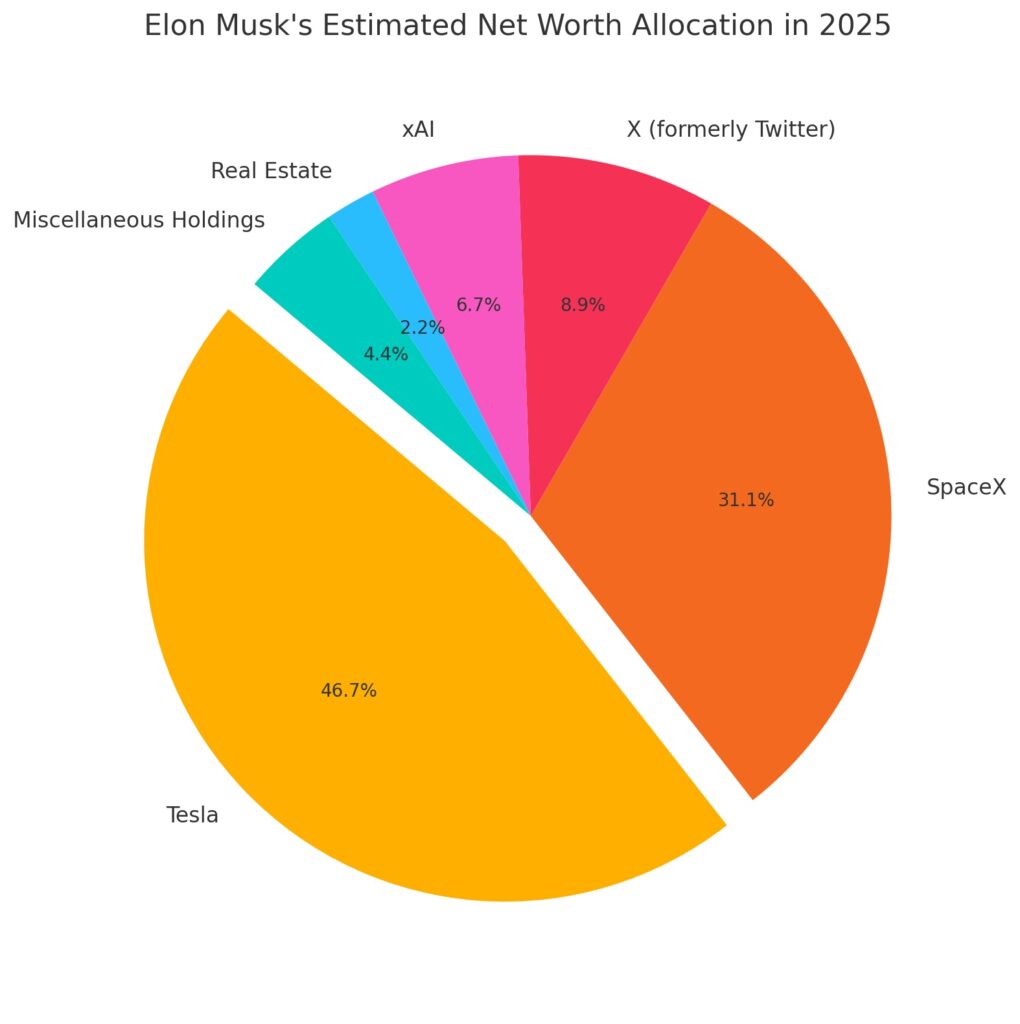

But these rankings only scratch the surface. Musk’s fortune is famously fluid — closely tracking public sentiment and stock performance, especially Tesla’s swings and SpaceX’s valuation shifts. Roughly 45–50% of his net worth remains locked in Tesla, where share prices continue to swing on everything from autonomous vehicle milestones to quarterly delivery targets. In 2025, the company is navigating a shifting EV landscape, with increased competition from Chinese automakers and regulatory pressure in Europe.

Meanwhile, SpaceX’s valuation has soared past $200 billion, boosted by the commercial success of Starlink, which is now generating significant revenue from both consumer internet and defense contracts. Though Musk’s stake isn’t fully liquid, private market demand has added weight to his paper wealth.

Musk also holds significant equity in X (formerly Twitter) and xAI, his generative AI startup that’s making waves with its chatbot Grok and infrastructure tools. These ventures are less transparent in value but are increasingly viewed as long-term growth plays, particularly as X pivots toward an “everything app” model.

From Startups to Stardom: Tracing Musk’s Wealth Timeline

Early Hustles — Zip2 and PayPal’s Legacy Millions

Before rockets and electric cars, Elon Musk’s fortune began with a scrappy startup spirit. In the late 1990s, he co-founded Zip2, a city guide software company, which sold to Compaq for $307 million — earning Musk around $22 million at just 27 years old. He quickly rolled that into X.com, an online banking venture that would merge into what we now know as PayPal. When PayPal sold to eBay in 2002, Musk walked away with $180 million. But instead of cashing out, he reinvested nearly all of it — a move that would launch the high-stakes empire we know today.

Betting Big on Tesla and SpaceX — The Billionaire Phase

Elon Musk didn’t inherit billionaire status — he bet his entire fortune to earn it. After PayPal, he poured $100 million into SpaceX and $6.3 million into Tesla’s Series A, risking everything on two industries littered with failure: space and electric vehicles. By 2008, both companies were near collapse — rockets were exploding, and Tesla couldn’t make payroll. Musk famously split his remaining cash to keep them afloat, sleeping on friends’ couches while funding what many saw as vanity projects. Then came the turning point: NASA awarded SpaceX a $1.6 billion contract, and Tesla secured crucial investment. That gamble — a total reinvestment in innovation — transformed Musk from a successful founder into a world-shifting billionaire icon.

Also See: Top 50 Richest Billionaires in the World

The 2020s Boom — Twitter, xAI, and Beyond

In the 2020s, Musk shifted from hardware to influence. His $44 billion acquisition of Twitter in 2022 wasn’t just a business deal — it was a pivot into narrative control, digital identity, and platform power. Rebranded as X, the platform now anchors Musk’s push toward an “everything app” ecosystem. Simultaneously, he launched xAI, a generative AI firm aiming to challenge OpenAI and Google with homegrown language models. These moves mark a departure from physical disruption to information domination — a playbook focused not just on building things, but on shaping how we communicate, think, and transact. It’s not just a billionaire strategy — it’s a playbook for influence in a world where attention, data, and AI are the new capital.

How Elon Musk Makes His Money: Companies Driving His Net Worth in 2025

Elon Musk doesn’t just build companies — he dismantles entire industries and rebuilds them from first principles. His fortune isn’t rooted in traditional capital accumulation but in an aggressive, almost philosophical commitment to technological disruption. Whether it’s launching reusable rockets with SpaceX or scaling autonomous driving systems at Tesla, Musk’s wealth is a byproduct of his ability to turn long-shot ideas into dominant, often category-defining businesses.

Take vertical integration, for example. Where most automakers rely on sprawling supply chains, Tesla designs its batteries, chips, and even manufacturing robots. This control doesn’t just cut costs — it allows for faster innovation cycles, which have given Tesla a sustained lead in the EV space and continue to drive its market valuation. Similarly, SpaceX’s full-stack control over rocket design and satellite deployment has made it not just a launch provider, but a global internet carrier via Starlink — opening new revenue streams and geopolitical influence.

Then there’s xAI, Musk’s latest venture into AI-native products. Rather than layering AI onto existing platforms, he’s building from the ground up — embedding intelligence into software, hardware, and even social interaction (via X). It’s a bet that the next trillion-dollar company won’t just use AI, but be AI at its core.

Musk’s playbook works because it fuses engineering obsession with market intuition. He doesn’t wait for trends — he engineers the conditions that make them profitable. For Musk, wealth is simply the exhaust trail of radical innovation.

What It Feels Like to Cover Elon’s Fortune

I’ve been tracking Elon Musk’s wealth for over a decade, and I still find myself surprised — not just by how fast it grows, but by how often it teeters on the edge of collapse. Covering his fortune doesn’t feel like reporting on a portfolio; it feels like chronicling the world’s most high-stakes game of conviction.

There was a moment in late 2022 I won’t forget. Tesla’s stock had plummeted more than 65% from its peak. Twitter (just rebranded as X) was in chaos. Musk was losing billions on paper by the week. I remember refreshing Bloomberg’s Billionaires Index every morning, half-expecting his name to drop below the top five. It didn’t — and that told me something deeper about the architecture of his empire.

Musk’s value isn’t just market cap. It’s momentum, myth, and a kind of industrial gravity. One tweet can tank a stock — or resurrect it. One launch failure can cost him billions — or prove his resilience.

People like to frame his fortune as volatile, and that’s true. But volatility doesn’t equal weakness. It’s the tax he pays for being perpetually ahead of the curve.

Writing about Elon’s net worth often means reporting numbers that feel unreal — but the real story is emotional, erratic, and sometimes wildly inspiring. You’re not just charting dollars. You’re watching someone rewrite what financial risk and reward look like in the modern age.

Comparative Lens — Where Elon Stands Among Billionaire Peers in 2025

Musk vs. Jeff Bezos, Bernard Arnault, and Mark Zuckerberg

As of mid-2025, Elon Musk sits atop the billionaire rankings with an estimated $380 billion, edging out Jeff Bezos ($226B), Bernard Arnault ($155B), and Mark Zuckerberg ($241B). But beyond the leaderboard, these fortunes reflect fundamentally different empires.

Arnault’s wealth is rooted in tangible luxury — LVMH thrives on heritage, scarcity, and elite consumption. Bezos, now less involved with Amazon, leans into space and media. Zuckerberg’s net worth has ballooned thanks to Meta’s dominance in virtual and AI-driven engagement.

Musk’s wealth, by contrast, is a volatile composite of high-stakes, high-concept ventures — EVs, AI, rockets, and social platforms. His fortune swings wider and faster than his peers, because it’s tied to industries that are still being invented in real time.

The Unique Wealth Profile of a Space-Faring CEO

Elon Musk’s wealth is a creature of the future — vast, visionary, and remarkably illiquid. Unlike many billionaires who hold diversified, cash-accessible assets, Musk’s net worth is overwhelmingly tied up in equity stakes across a handful of high-risk ventures: Tesla, SpaceX, X, and xAI.

At any given moment, a dip in Tesla stock — still the core pillar of his fortune — can erase tens of billions in paper value. SpaceX, while valued at over $200 billion, remains a private company, limiting Musk’s ability to convert that stake into usable capital. His ownership in X and xAI is even more speculative, with valuations shifting alongside evolving business models and emerging tech landscapes.

Add to that Musk’s aversion to asset-selling — he’s known for using margin loans rather than liquidating shares — and you get a profile that’s deeply exposed to market swings. His wealth is stratospheric, but it rides on the same turbulence as the rockets he builds.

The Dark Side of Billionaire Valuation: Volatility and Public Scrutiny

For all its magnitude, Elon Musk’s fortune lives on a razor’s edge. His net worth doesn’t just reflect business fundamentals — it’s a mirror of his public persona. And when that persona clashes with norms, regulations, or investor confidence, the financial consequences are immediate.

Consider late 2023, when Musk posted politically charged commentary on X, prompting a wave of advertiser exits from the platform. Within days, media headlines questioned X’s future viability, and Tesla’s stock dipped by 7% — not because of earnings, but because of reputational bleed. Investors, it turns out, don’t separate the man from his empire as neatly as Musk might hope.

Government scrutiny also plays a role. Regulatory probes into Tesla’s Autopilot program, union disputes at Gigafactories, and questions surrounding SpaceX’s satellite deployments all have one thing in common: they spook markets. Even rumors of an SEC investigation or an FTC inquiry have caused Musk-affiliated stock to flutter.

Then there’s the Twitter/X effect. Musk’s ownership of the platform made him a political lightning rod — and with that came volatility. Advertisers pulled back, journalists scrutinized every move, and user trust seesawed. The very platform that Musk saw as a tool for influence became, at times, a liability for his broader valuation.

In the world of public billionaires, optics are assets. For Musk, perception doesn’t just shape public opinion — it directly shapes his bottom line. His fortune is a living entity, built as much on belief as on balance sheets. And belief, as we know, is fragile.

What Fuels Future Growth? Musk’s Next Billion-Dollar Bets

Elon Musk’s future wealth may not lie in cars or rockets — but in connectivity, intelligence, and financial ecosystems. The clearest engine on the horizon is Starlink, SpaceX’s satellite internet constellation. With over 6,000 satellites in orbit and growing traction in both consumer and defense markets, Starlink is quietly transitioning from experimental infrastructure to a global telecom force. Musk has hinted at an eventual IPO — a move that could unlock tens of billions in value and provide a new liquidity channel.

Then there’s xAI, Musk’s answer to OpenAI and Google DeepMind. Its flagship product, Grok, is already integrated into X and designed to evolve as a real-time, truth-seeking model. But Musk’s bigger vision seems to involve full-stack AI infrastructure, from chips to data centers — potentially linking Tesla’s hardware capabilities with xAI’s software brain.

Also in play: the long-teased transformation of X into a financial platform. With peer-to-peer payments, crypto rails, and an “everything app” ambition, Musk could tap into fintech markets without building a bank.

What ties it all together is Musk’s pattern: enter a market dominated by incumbents, rewrite the cost structure, and scale aggressively. If history is any guide, his next fortune will come not from chasing trends — but from redrawing the map entirely.

Lessons from Musk’s Journey: Wealth, Risk, and Vision

Elon Musk’s rise isn’t just a case study in success — it’s a meditation on the price of relentless vision. His path shows that modern wealth isn’t built through incremental gains or portfolio diversification. It’s built through total immersion: in ideas that seem implausible, in markets others avoid, and in a willingness to risk almost everything — including reputation — to make them real.

But Musk’s journey also reveals the fragility beneath the fortune. His empire is shaped as much by narrative and perception as it is by engineering. He’s a builder, yes — but also a performer, a provocateur, a myth-maker. The same qualities that attract investment can also provoke backlash. It’s a reminder that in today’s economy, wealth is rarely just numerical; it’s emotional, social, and deeply volatile.

For entrepreneurs, Musk is proof that obsession can scale — but not without turbulence. For investors, he’s a warning that vision-driven empires are thrilling, but not always stable. And for everyone else, his story is a lens into how power, risk, and belief now intersect in the making of modern billionaires.

Musk didn’t just disrupt industries. He disrupted the blueprint for how wealth itself is earned, exposed, and endured.

Musk’s Fortune as a Mirror of Modern Capitalism

Elon Musk’s 2025 net worth isn’t just a scoreboard — it’s a reflection of what modern capitalism rewards: audacity, innovation, volatility, and narrative control. His wealth moves with the market, yes, but also with mood, momentum, and media. He builds real technologies — rockets, AI systems, satellites — yet his fortune often hinges on belief more than balance sheets.

In a time when capital flows toward vision more than legacy, Musk embodies a new kind of billionaire: part engineer, part influencer, part oracle of the future. His empire is not only sprawling, but symbolic — a case study in how ambition becomes asset class.

So what does it say that the richest man in the world is betting everything on things that don’t yet exist? Perhaps the deeper question isn’t how Musk got so rich — but what kind of world we’re building that makes it possible.

Mohit is a finance and entertainment writer specializing in celebrity wealth, brand strategy, and media empires. As Co-Founder of TheNetWorths.com, he brings over a decade of experience analyzing public income streams, endorsement deals, and the evolving creator economy.

7 thoughts on “Elon Musk Net Worth 2025: How the World’s Richest Built a $380 Billion Tech & Space Empire”