In 2025, Mark Zuckerberg isn’t just one of the richest individuals in the world—he’s the most talked-about figure in the ongoing transformation of the digital age. Once pegged as the hoodie-wearing Facebook founder, he now stands at the center of a sprawling empire that extends beyond social media and deep into the architecture of virtual reality, artificial intelligence, and spatial computing. His wealth—estimated in the ballpark of $247 billion depending on the day—isn’t just impressive in scale; it’s emblematic of a tech industry that no longer revolves around screens alone, but immersive ecosystems.

But what’s most striking isn’t the size of Zuckerberg’s fortune—it’s how it evolved. In the wake of a post-pandemic economy and a rapidly maturing AI market, many tech giants pivoted cautiously. Zuckerberg doubled down. He rebranded his company, bet billions on the Metaverse before the world knew what to make of it, and endured years of skepticism. Today, that gamble is beginning to pay off—not just financially, but in terms of cultural and technological relevance.

This isn’t just a story of numbers—it’s a narrative about risk, reinvention, and what it takes to stay powerful when the rules of the game keep changing.

Net Worth in 2025: The Cold, Hard Numbers

As of mid-2025, Mark Zuckerberg’s net worth is estimated at $247 billion, according to Forbes and the Bloomberg Billionaires Index. That figure puts him comfortably within the top five richest people in the world, right alongside Elon Musk and Bernard Arnault. But as with most tech billionaires, the majority of that wealth isn’t sitting in cash—it’s tightly tied to the performance of Meta Platforms Inc.

Roughly 85% of Zuckerberg’s net worth is linked to his ownership stake in Meta, which rebounded significantly after a rocky few years. In 2022 and 2023, Reality Labs (Meta’s AR/VR division) posted billions in losses, and investor confidence wavered. But by 2024, Meta’s Metaverse infrastructure and AI-driven products started gaining traction—especially in enterprise, gaming, and education sectors—driving the company’s market cap to record highs.

Beyond Meta stock, Zuckerberg holds private investments in emerging tech companies, real estate (including sprawling estates in Hawaii and California), and a modest portfolio of philanthropic LLCs under the Chan-Zuckerberg umbrella.

To put things in perspective: in early 2020, his net worth hovered around $80 billion. By doubling that figure in just five years—amid economic volatility and intense public scrutiny—Zuckerberg has proven that his financial arc is still rising. But the story behind those numbers is even more compelling, especially when you look at how he got here.

From Dorm Room to Dominance: The Early Wealth Timeline

It started, famously, in a Harvard dorm room. Mark Zuckerberg, then a 19-year-old computer science student with a knack for code and a sharp sense of digital human behavior, launched TheFacebook in 2004 as a campus experiment. But it wasn’t long before that project morphed into something far more ambitious—and far more lucrative.

By his early twenties, Zuckerberg had already rejected major buyout offers (including a $1 billion bid from Yahoo) and committed to building Facebook into the default social infrastructure of the internet. That refusal to cash out early wasn’t just stubborn—it was strategic. It signaled a founder who understood that control over a growing digital ecosystem was worth more than any short-term payout.

The real turning point came with the 2012 IPO, which instantly made Zuckerberg a billionaire several times over. But what cemented his future wealth were two shrewd acquisitions: Instagram in 2012 for $1 billion, and WhatsApp in 2014 for $19 billion. At the time, critics scoffed at the price tags. Today, those deals are considered two of the most profitable tech acquisitions in history, anchoring the company’s dominance in mobile engagement and global communication.

A clear pattern emerges in this early phase: Zuckerberg didn’t just build a platform—he acquired entire ecosystems. And by betting on user attention and network effects rather than immediate monetization, he laid the foundation for the kind of scale—and wealth—that few in Silicon Valley have ever matched.

Betting the Future: How the Metaverse Reshaped His Fortune

In 2021, when Mark Zuckerberg announced that Facebook was rebranding to Meta, the tech world collectively raised an eyebrow—and Wall Street flinched. It wasn’t just a cosmetic name change. It was a declaration of intent: Meta would no longer be defined solely by its social media platforms. Instead, Zuckerberg was placing a multi-billion-dollar bet on building the next iteration of the internet itself—the Metaverse.

That bet was anything but safe.

In the years that followed, Reality Labs, Meta’s division responsible for AR/VR and spatial computing, hemorrhaged capital. By the end of 2023, cumulative losses exceeded $45 billion, and investors were growing restless. Meta’s stock dipped, analysts questioned Zuckerberg’s grip on reality, and competitors like Apple and Microsoft took more measured, incremental steps into immersive tech. But while others tested the water, Zuckerberg was swimming in the deep end.

And now, in 2025, signs of vindication are beginning to surface.

Meta’s Quest hardware is no longer just a niche gaming device—it’s evolved into a platform for enterprise collaboration, virtual education, and hybrid workspaces. Horizon Worlds, after a rocky start, has found footing among Gen Z and early adopters in emerging markets. Most notably, Meta’s integration of AI avatars and generative environments has attracted both developers and advertisers, finally bridging utility and scale.

The infrastructure Zuckerberg built—servers, silicon, software, and standards—may not have been profitable immediately, but it positioned Meta as a foundational player in a space that’s growing faster than anticipated. The Metaverse hasn’t fully arrived, but it’s no longer science fiction.

Zuckerberg’s willingness to stomach short-term volatility in pursuit of long-term transformation speaks to a core philosophy: real wealth—and real power—often come from being early, bold, and unshakably certain.

If I Were Mark Zuckerberg in 2025

If I were Mark Zuckerberg in 2025, sitting at the helm of Meta with over a hundred billion to my name and a still-skeptical public watching, I imagine I’d be reflecting less on the number in my bank account and more on the years spent defending a vision no one else fully believed in.

There were times—especially in 2022 and 2023—when it felt like I was steering a ship through fog with everyone shouting that I’d missed the lighthouse. Reality Labs was burning billions. Horizon was clunky. Even my peers whispered that maybe I’d lost the plot. But I couldn’t shake the sense that the next version of human connection wouldn’t come through comments and likes—it would be presence.

Now, in 2025, I can see the edges of that bet starting to materialize. The Metaverse still isn’t mainstream, but it’s no longer a punchline either. It’s being used—in classrooms, in workplaces, in ways that are starting to look normal. That matters.

If I’ve learned anything, it’s that money follows conviction—but only if you’re willing to look foolish for a while. I don’t know if history will call it brilliance or stubbornness. But I do know that real innovation doesn’t wait for consensus. You build it, you take the heat, and then—if you’re lucky—you watch it work.

Key Revenue Streams: Where the Money Really Comes From

Zuckerberg’s fortune in 2025 isn’t just the product of Meta’s stock performance—it’s the outcome of a carefully diversified digital empire. While social media ads remain the core money-maker, the pillars of his wealth have grown far more complex, reflecting both the maturation of Meta and the founder’s appetite for long-term bets.

First, digital advertising still delivers the lion’s share of Meta’s revenue. Platforms like Facebook, Instagram, and WhatsApp—now deeply integrated with AI-driven ad targeting and generative content tools—pull in hundreds of billions in ad spend annually. But the big story of 2025 is that Meta’s ad business has successfully extended into immersive environments, thanks to interactive, 3D ad placements in Horizon and branded spaces in VR.

Second, Quest hardware and XR software have matured into a full-stack platform. What was once considered a niche gadget is now a productivity and entertainment staple, particularly in enterprise settings. Sales of headsets, spatial computing accessories, and Meta’s proprietary OS contribute meaningful revenue—and more importantly, customer lock-in.

Then there’s the AI and enterprise layer: Meta’s LLM-powered collaboration tools, synthetic media engines, and avatar infrastructure are being licensed to developers and corporations. It’s not flashy, but it’s high-margin.

Outside of Meta, Zuckerberg’s investments in AI startups, biotech ventures, and clean energy projects—often through Chan-Zuckerberg Initiative vehicles—signal his growing interest in solving global-scale problems that just so happen to align with tech’s next frontiers.

Taken together, these streams show that Zuckerberg isn’t just monetizing attention—he’s engineering platforms that will shape how we work, live, and communicate for decades to come.

How Zuckerberg Stacks Up Against Silicon Valley Titans

In 2025, Mark Zuckerberg remains a formidable figure among Silicon Valley’s elite—but the game has changed, and so have the players. With an estimated net worth of $247 billion, he’s still firmly in the upper echelon, trailing only slightly behind Elon Musk and Jeff Bezos. But unlike Musk’s flashy moonshots or Bezos’s post-Amazon portfolio sprawl, Zuckerberg’s wealth strategy is less about spectacle and more about systems—building enduring platforms that generate value over decades.

What sets Zuckerberg apart is how he consolidates power. While Musk toggles between electric cars, rockets, and social chaos, and Bezos invests in everything from healthcare to media, Zuckerberg has doubled down on a singular, immersive vision: the Metaverse. It’s risky, yes—but also unified, focused, and increasingly influential.

Tim Cook, by contrast, has grown Apple’s empire through precision and polish, but he’s more operator than visionary. Sundar Pichai leads with quiet competence at Alphabet, but rarely commands the same personal narrative.

Zuckerberg may lack Musk’s cult of personality or Bezos’s diversification, but his wealth is rooted in infrastructure and user behavior, not media moments. In a world where tech leaders are increasingly seen as influencers, he’s playing a longer, quieter game—and, at least for now, still winning.

Comparison Table: Estimated Net Worths in 2025

| Name | Company/Focus | Est. Net Worth | Dominant Strategy |

| Elon Musk | Tesla, X, SpaceX | $380B | High-risk, high-visibility |

| Jeff Bezos | Amazon, Blue Origin | $234B | Diversification, private equity |

| Mark Zuckerberg | Meta, Metaverse | $247B | Platform building, long-term vision |

| Tim Cook | Apple | $2.2B | Operational mastery |

| Sundar Pichai | Google/Alphabet | $1.1B | Stable, innovation-by-increment |

Public Perception and Personal Brand Value

By 2025, Mark Zuckerberg’s public image remains as paradoxical as ever. He’s a figure who inspires both admiration and unease—a genius engineer who built the social scaffolding of the modern internet, but who’s also been criticized for aloofness, tone-deaf decisions, and a perceived detachment from the real-world consequences of his platforms.

His rebrand from Facebook to Meta was, in part, an attempt to reset that image. In some ways, it worked: younger users now associate Meta less with social media scandals and more with innovation—VR, AI, spatial computing. But for others, Zuckerberg is still the billionaire behind the curtain, quietly shaping the rules of digital life without the charisma or accessibility of his peers.

That perception matters. In tech, brand value is tethered not just to products, but to the personalities behind them. Investors may trust Zuckerberg’s long-term thinking, but his lack of media charm or public vulnerability has kept him at a distance. Unlike Elon Musk, who thrives on controversy, or Tim Cook, who exudes steadiness, Zuckerberg remains something of a cypher.

Still, his ability to weather storms, outlast hype cycles, and keep building gives him a kind of quiet credibility. In a sector obsessed with disruption, there’s something reassuring about a leader who doesn’t try to be liked—only to be right.

Philanthropy and Long-Term Legacy Moves

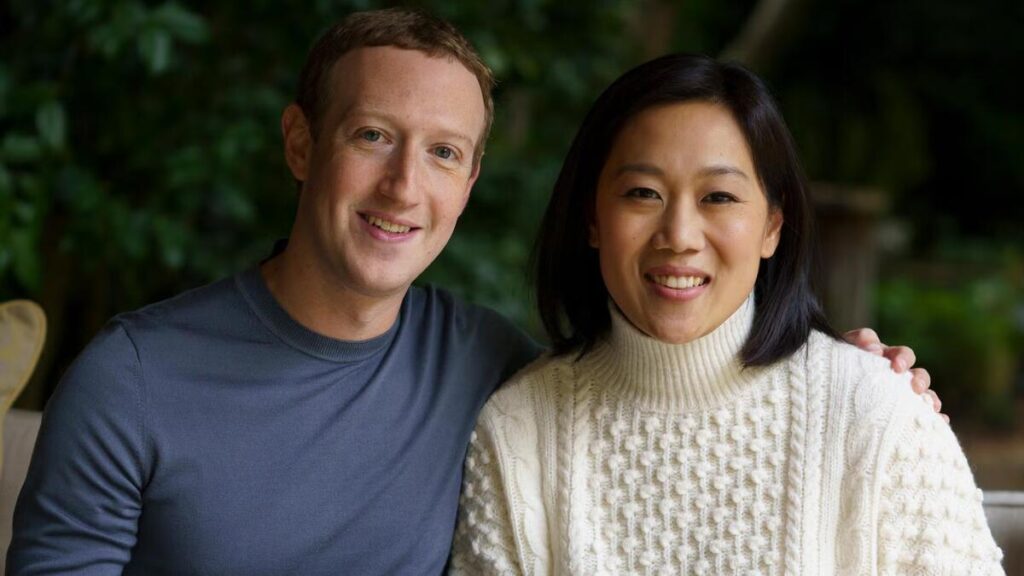

While Mark Zuckerberg’s wealth commands headlines, his quieter, long-game approach to philanthropy may ultimately define his legacy. Through the Chan-Zuckerberg Initiative (CZI)—founded with his wife, Priscilla Chan—Zuckerberg has pledged to give away the majority of his fortune over his lifetime. But unlike traditional charity, CZI operates as an LLC, not a nonprofit, allowing it to invest in startups, influence policy, and fund research with greater flexibility.

In 2025, CZI continues to pour billions into education, biomedical science, and criminal justice reform, with a growing focus on AI applications for healthcare and predictive disease modeling. These aren’t feel-good projects—they’re bets on systemic change, shaped by the same data-driven mindset that built Facebook’s ad engine.

Critics still question whether this model blurs the line between altruism and control, but it reflects a broader shift in billionaire philanthropy: less reactive giving, more legacy engineering. Tax efficiency, social influence, and future-proofing one’s name now play as much a role as moral obligation.

For Zuckerberg, the CZI isn’t just about charity—it’s about shaping a version of the future where his values, not just his technologies, endure.

The Making (and Re-making) of a Modern Mogul

Mark Zuckerberg’s 2025 net worth isn’t just a number—it’s the sum of nearly two decades of relentless iteration, calculated risk, and unshakable conviction. From a college dorm project to a social media empire, from ad dollars to immersive worlds, his fortune reflects more than financial success—it charts the evolution of tech itself.

He bet early on connectivity, doubled down on ownership, and then pivoted hard toward the future with the Metaverse, enduring backlash and billions in losses along the way. And while he may never be the most charismatic or beloved figure in Silicon Valley, he remains one of its most enduring architects.

Zuckerberg’s journey reveals a deeper truth about modern moguls: the ones who shape the world aren’t always the loudest—they’re the ones still building when the spotlight moves on. His story isn’t just about how much he’s worth, but what he’s willing to invest in shaping what comes next.

Mohit is a finance and entertainment writer specializing in celebrity wealth, brand strategy, and media empires. As Co-Founder of TheNetWorths.com, he brings over a decade of experience analyzing public income streams, endorsement deals, and the evolving creator economy.

4 thoughts on “Mark Zuckerberg Net Worth 2025: How He Built a $247 Billion Tech Empire Through Meta”