In an era where headlines are dominated by trillion-dollar tech giants and flashy crypto tycoons, Michael Bloomberg’s wealth remains a study in quiet, calculated power. At 83, he’s neither the youngest nor the loudest billionaire in the room — and yet, his estimated net worth of $104.7 Billion in 2025 still commands attention. Why?

Because Bloomberg’s fortune wasn’t built on a social app or a single market-defying bet. It was architected — brick by brick — over four decades of strategic reinvention. From his ousting at Salomon Brothers to launching the Bloomberg Terminal that would transform global finance, to serving three terms as New York City’s mayor, Bloomberg’s rise is less about luck and more about leverage: of timing, of influence, and of information.

But what does that kind of wealth look like in 2025, not just in dollars, but in impact? Has his political and philanthropic footprint grown in step with his fortune? And how does Bloomberg’s model of wealth-building compare to today’s digital dynasties?

This isn’t just a profile of a billionaire. It’s a blueprint for long-game thinking in a world obsessed with immediacy. Let’s unpack how Michael Bloomberg built — and continues to evolve — one of the most distinctive fortunes of our time.

From Salomon Brothers to Bloomberg L.P.: The Genesis of a Billion-Dollar Empire

Every empire has a spark — and for Michael Bloomberg, it was a pink slip.

In 1981, after nearly 15 years at Salomon Brothers, Bloomberg was unceremoniously let go following the firm’s merger. At the time, he wasn’t a high-profile Wall Street titan but a mid-tier partner overseeing systems and analytics. But unlike many of his peers who might have seen that moment as a career end, Bloomberg saw a pivot point — and more importantly, a gap in the market that no one else was filling.

What traders lacked in the early ’80s wasn’t instinct or ambition — it was real-time, reliable data. Bloomberg had witnessed firsthand how clunky, delayed, and inconsistent financial information was. So with a $10 million severance and a vision, he founded Innovative Market Systems — the company that would become Bloomberg L.P.

His bet? That the future of finance wasn’t just in buying and selling but in accessing the right data faster than anyone else. He pitched his idea to Merrill Lynch, who became his first client — and his first investor.

This wasn’t just a rebound story. It was a strategic reinvention at the crossroads of finance and emerging tech. Bloomberg’s genius wasn’t just building hardware and terminals — it was building trust in a product that Wall Street didn’t yet know it needed. And once traders got hooked on the speed and accuracy of Bloomberg data, there was no going back.

The foundation of his fortune wasn’t laid on hype or timing — it was insight, delivered at scale. And in many ways, that first leap from banker to builder would foreshadow every move he made thereafter: unconventional, data-driven, and always several steps ahead of the pack.

The Bloomberg Terminal Effect: Turning Financial Data into Gold

To understand how Michael Bloomberg built a multi-billion-dollar fortune, you have to understand the power of a glowing black box.

The Bloomberg Terminal — that sleek, keyboard-cluttered machine with orange-on-black screens — has become the heartbeat of global finance. From investment banks in New York to sovereign funds in Singapore, it’s not just a tool; it’s the standard. Even in 2025, with dozens of platforms competing for market share, the Bloomberg Terminal retains a near-mythic grip on the financial world.

What makes it so valuable? In a word: trust.

Launched in the early ’80s, the Terminal revolutionized how traders accessed data. Before Bloomberg, financial professionals relied on newspapers, phone calls, and delayed market reports. Suddenly, they had real-time quotes, historical data, analytics, and breaking news — all in one place, with a few keystrokes. That kind of speed + accuracy wasn’t just convenient — it was profitable.

By offering exclusive tools and proprietary data, Bloomberg created a product that was indispensable. And he priced it accordingly. As of 2025, terminals cost upwards of $25,000 per year — and there are hundreds of thousands of them in use globally. That’s a subscription model most tech founders only dream of.

One former hedge fund analyst summed it up best: “You can trade without Bloomberg — but you’d rather not. It’s like trying to compete in Formula 1 without telemetry.”

But it wasn’t just about data. Bloomberg L.P. built a whole ecosystem: instant messaging, research archives, trading tools, and even internal social networks. The stickiness of the product — once you’re in, you’re all in — ensured retention rates that defy typical SaaS benchmarks.

The Terminal didn’t just deliver data. It sold certainty in an uncertain world — and that’s what turned a single idea into a $25+ billion-a-year enterprise.

A Mayor, A Mogul: How Public Office Amplified Private Wealth

On paper, Michael Bloomberg’s 12-year stint as mayor of New York City came at a personal financial cost — he famously took a $1 annual salary. But dig beneath the symbolism, and a more layered story emerges: one where public service and private fortune quietly reinforced each other.

Being mayor of the most scrutinized, high-stakes city in the world made Bloomberg more than a billionaire — it made him a global brand. His leadership during crises like 9/11’s aftermath, the 2008 financial collapse, and Hurricane Sandy positioned him not just as a businessman but as a measured, pragmatic problem-solver. That image didn’t just win headlines — it won trust.

And trust is priceless in the world of finance.

While Bloomberg was careful to separate his mayoral duties from his company, the reality is that his elevated public profile brought indirect benefits. Heads of state, Fortune 500 CEOs, global investors — all now saw Bloomberg not just as the founder of a data empire, but as someone who could lead a city like a business. That perception mattered. It amplified the brand equity of Bloomberg L.P., especially in global markets where public credibility influences partnerships.

There’s also the media effect. Coverage of Bloomberg, the mayor often referenced Bloomberg the company. The name became unavoidable, and that visibility is something no marketing budget could replicate.

In short, while he didn’t profit directly from City Hall, the halo of political leadership added gravity to his personal and corporate reputation. Bloomberg’s wealth wasn’t built in office — but it was, in many ways, fortified there.

Philanthropy or Financial Strategy? Giving While Growing

Michael Bloomberg has pledged to give away the bulk of his fortune — and by all accounts, he’s well on his way. Through Bloomberg Philanthropies, he has donated over $14 billion to causes ranging from tobacco control and gun safety to climate resilience and educational equity. But here’s the twist: even as the billions flow out, Bloomberg’s net worth keeps rising.

Is this generosity, strategy — or both?

The answer lies in the intersection of legacy-building and influence. Bloomberg’s philanthropic model mirrors his business mindset: data-driven, results-focused, and highly scalable. Whether funding anti-smoking campaigns in developing countries or supporting city-level sustainability initiatives, his giving has global reach — and measurable ROI in terms of social impact.

But it’s also strategic. High-profile initiatives elevate his name in elite policy circles, open doors in global governance, and reinforce his identity as more than just a businessman. In 2019, UN Secretary-General António Guterres appointed Bloomberg as Special Envoy for Climate Ambition — a role he likely wouldn’t have earned without years of philanthropic credibility.

There’s also a financial architecture at play. Many of his donations are channeled through long-term vehicles like donor-advised funds and foundations, which offer tax efficiencies while maintaining control over disbursements. This isn’t cynical — it’s smart stewardship, and common among legacy-minded billionaires.

As Ford Foundation President Darren Walker put it, “Bloomberg doesn’t just give money. He gives structure, accountability, and urgency.”

Ultimately, Bloomberg’s philanthropy reflects the same discipline that built his fortune: a focus on long-term impact, tightly managed execution, and a clear view of how values and value creation can coexist.

Also See: Top 50 Richest Politicians in the World

Net Worth in 2025: Breaking Down the $104.7 Billion Estimate

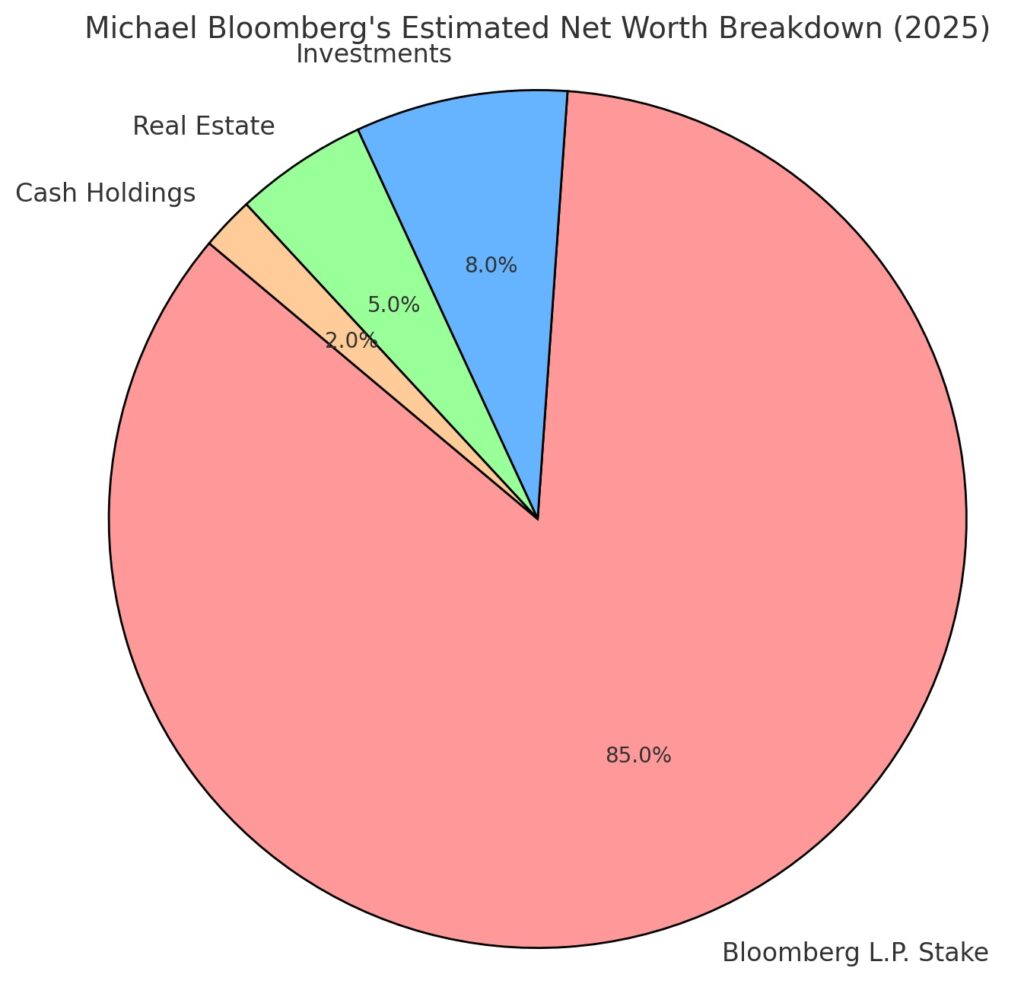

As of mid-2025, Michael Bloomberg’s net worth is estimated at approximately $104.7 Billion, according to Forbes — a figure that places him among the world’s ten richest individuals. But what exactly makes up that staggering number?

First and foremost is his 88% ownership stake in Bloomberg L.P., the private financial data and media giant he founded in 1981. The company reportedly generates over $13 billion in annual revenue, with a valuation hovering near $100 billion. Since it’s privately held, this valuation is based on comparable revenue multiples and investor sentiment in the fintech space — making it the core, but also the most variable, element of Bloomberg’s wealth.

Then there are his investments and assets: a portfolio of global equities, venture funds, and fixed-income holdings. While Bloomberg keeps his investment strategies relatively private, insiders suggest a conservative, diversified approach. Add to that an impressive real estate portfolio, including homes in New York, London, Colorado, and Bermuda — collectively worth hundreds of millions.

To put it in perspective: if Bloomberg’s fortune were a national economy, it would rank higher than over 100 countries’ GDPs, including Croatia and Cambodia.

What’s striking is how stable his wealth has remained over time. Unlike tech founders whose fortunes fluctuate wildly with the markets, Bloomberg’s income engine — subscription-based, B2B, and entrenched in global finance — offers remarkable resilience.

Ultimately, Bloomberg’s 2025 net worth isn’t just a headline number. It’s a reflection of one of the most sustainable, quietly compounding fortunes in modern history.

Bloomberg vs. The Billionaire Benchmarks: How He Stacks Up in 2025

At $104.7 Billion, Michael Bloomberg’s net worth in 2025 puts him firmly among the world’s wealthiest individuals, but raw numbers only tell part of the story. To truly understand Bloomberg’s place in the billionaire ecosystem, it helps to compare not just the amount, but the architecture of his fortune.

Take Jeff Bezos, whose net worth, fluctuating around $226 billion, is tied tightly to Amazon’s publicly traded stock. Or Warren Buffett, with roughly $170 billion, largely in Berkshire Hathaway shares. Larry Fink, CEO of BlackRock, has a smaller fortune (estimated at $1.5 billion) but enormous institutional influence.

Bloomberg? He’s different.

His wealth comes from a privately held empire, Bloomberg L.P., which he still controls almost entirely. That means no shareholders, no quarterly earnings calls, and far less public scrutiny. While tech moguls often build sprawling portfolios with volatile valuations, Bloomberg’s is streamlined, stable, and rooted in subscription revenue from financial institutions that can’t operate without its tools.

There’s also brand presence. Bezos launched into space. Musk tweets market-moving memes. Bloomberg, by contrast, cultivates low-profile power — moving in policy circles, funding global health campaigns, and attending economic summits with heads of state. He rarely chases headlines — but he helps shape them.

In short, Bloomberg is the rare billionaire whose fortune is quiet, concentrated, and enduring — a model of wealth that grows steadily behind the scenes, rather than on the front page.

What Bloomberg’s Story Teaches About Wealth & Reinvention

If I had to explain Michael Bloomberg’s wealth-building mindset in one word, it would be: engineered.

What struck me most while researching his journey wasn’t just the size of his fortune — it was the precision with which he built it. This isn’t someone who stumbled into success or surfed the wave of a market trend. Bloomberg created his wave, and then quietly rode it for decades.

He turned a career setback — getting fired — into a springboard. He didn’t chase the spotlight, yet he ended up running one of the world’s most influential cities. He didn’t build a flashy consumer brand, but instead chose a niche that became indispensable to the global economy.

There’s something quietly radical about that.

In a world obsessed with disruption and virality, Bloomberg’s story is about consistency, trust, and scale. He knew where the value was — in information, in speed, in accuracy — and he built a company that delivered those things without compromise. And he kept building, even while governing, giving, and adapting.

To me, Bloomberg isn’t just a billionaire. He’s a reminder that reinvention isn’t about changing who you are — it’s about doubling down on what you see that others don’t. His legacy isn’t just wealth. It’s clarity of purpose.

Also See: Top 50 Richest Billionaires in the World

What’s Next for Bloomberg? Forecasting the Future of a Billionaire Brand

At 83, Michael Bloomberg shows no signs of fading into the background. If anything, the next chapter of his legacy may be just as consequential as the last — not through personal reinvention, but through institutional evolution.

Bloomberg L.P. is actively expanding into AI-powered analytics, real-time ESG data, and green finance tools that cater to the growing demands of climate-conscious investors. The company’s push toward integrating AI for predictive modeling and automated compliance tracking suggests a future where Bloomberg’s platform isn’t just reactive, but strategically anticipatory.

Then there’s the question of succession. While Bloomberg hasn’t named a clear heir, insiders note that he’s focused on building leadership teams that prioritize integrity and mission over flash. Legacy, for him, isn’t about a nameplate — it’s about function and impact.

On the philanthropic front, Bloomberg Philanthropies is scaling global public health initiatives and climate policy interventions, with partnerships that outlast any election cycle. In a 2024 interview, he noted, “You don’t build something just for your lifetime. You build it to outlive you — or it wasn’t worth building.”

In short, Bloomberg’s future isn’t about retirement — it’s about relevance. Through technology, governance, and giving, he’s laying the groundwork for a brand of leadership and impact that endures well beyond the man himself.

Michael Bloomberg’s Fortune Is More Than Money — It’s a Legacy Engineered by Intent

Michael Bloomberg’s fortune isn’t just a testament to financial success — it’s a reflection of how success is built when vision meets patience and precision. His $104.7 Billion net worth in 2025 tells a story far bigger than dollar signs: one of discipline over spectacle, structure over chaos, and service woven into strategy.

What makes Bloomberg exceptional isn’t just that he built one of the world’s most powerful private companies — it’s that he did it without chasing trends, and then used that platform to influence public health, education, and climate on a global scale.

In a world where fortunes rise fast and fade even faster, Bloomberg’s legacy stands as something rarer: engineered, intentional, and built to last. Not because he needed more, but because he believed that what you build — and what you leave behind — should be bigger than you.

Nishant is a digital strategist and celebrity finance analyst with over 15 years of experience in SEO-driven content. As Founder of TheNetWorths.com, he creates high-authority profiles on wealth, branding, and cultural influence.

5 thoughts on “Michael Bloomberg Net Worth 2025: How the Billionaire Built a $104.7 Billion Media & Philanthropic Empire”